Many financial marketers assume that Millennials don't like, don't open and don't read direct mail pieces. Not true.

Direct mail still resonates with every age group. This is among the findings from a study by InfoTrends and Prinova. And it doesn’t just work (or work less than it once did), the response rates for direct mail remain high for all demographics.

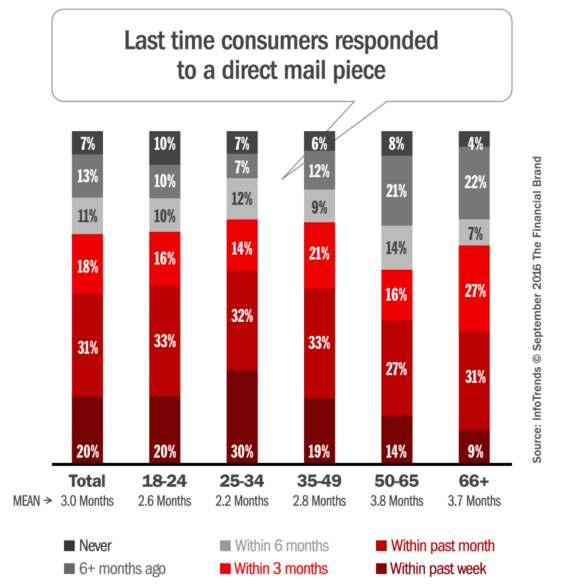

Some might find the response rate for Millennials particularly surprising, since they are by far the most digitally-savvy generation in history. According to another study fielded by Experian, nearly every Millennial (ages18-35) owns a smartphone, and 43% say that they now access the internet more through their phone than a computer, compared with just 20% of adults ages 35 and older. However, despite their hyper-wired digital connectedness, Millennials as a group report that the last time they responded to direct mail campaign was within 2.4 months. That’s less than the average response time for all respondents. Similarly, Millennials open the direct mail they receive at the same high rate of 66% as recipients overall.

Even more significant, the InfoTrends research found that 63% of Millennials who responded to a direct mail piece within a three month period actually made a purchase.

A study by the USPS reached a similar conclusion about Millennials’ interest in receiving political direct mail. “As the much-coveted demographic of 18-24-year-olds has grown up with- and around computers, focusing exclusively on digital channels seems like the obvious strategy,” says Cliff Rucker, VP of Sales at USPS. “Actually, Millennials are far more likely than non-Millennials to read and engage with direct mail.”

The reasons consumers continue to open and engage with direct mail are many, but interest in the products and services offered tops the list. One quarter of those in the 25-34 year old age range say they opened direct mail because of the print and image quality, and 25% of Millennials consider reading direct mail a leisure activity. Personalization is another factor with a very strong influence on whether a recipient will open the direct mail they receive.

Moreover, an equal number of consumers say they prefer direct mail over email and vice versa. Response rates are similar between direct mail and email, too. Just as many consumers say they are likely to take action in response to direct mail vs. email, or are equally likely to take action in response to either direct mail or email communications. This result validates the value of cross-channel marketing (also called “integrated, multi-channel marketing”).

- Direct mail is frequently read by all demographic groups, including digitally adept Millennials

- A high percentage of consumers had responded to direct mail within the three months prior to answering the survey

- A top goal of surveyed organizations is to improve data-driven personalization and relevant communications with their direct mail

- Almost two-thirds of marketers report they are attempting to coordinate direct mail with other marketing activities

- Direct mail drives both online and bricks and mortar traffic

- Most importantly, direct mail continues to trigger sales

For these reasons, direct mail continues to be effective for the marketers sending it and for the consumers who receive it. The allure of digital channels should not cause financial services firms to forget that direct mail remains critical to the overall media mix and can help drive cross-channel engagement.

Ensuring Direct Mail Effectiveness

The research from InfoTrends revealed that more than 37% of the data that marketers require for an effective direct mail campaign is actually controlled by IT — not marketing — signaling the need to leverage customer communications management (CCM) technologies that can help financial marketers merge silos of critical-yet-disparate data repositories.

To get the most out of direct mail, banks and other financial services firms should make sure the CCM platform used to create the direct mail provides an intuitive interface for non-technical users to easily visualize and build out content and rules intended for each touchpoint. It should also enable a high degree of variability to service end consumer recipients with information that is highly relevant and personalized to their needs, ultimately leading to an improved customer experience.

Direct mail has the proven ability to make a powerful impact with color, personalization and more. The InfoTrends study affirms that increased integration of direct mail with other channels is proving to be an effective strategy for reaching consumers… including Millennials.

Nick Romano is the CEO of Prinova, Inc. He specializes in business process reengineering for enterprises migrating to new document delivery solutions. He is a graduate of McMaster University in Hamilton, Ontario with a Bachelor’s Degree in engineering and management. You can connect with Nick via email or follow him on